Use Constants for Non-assigned Processes

Overview

In this blog, I will demonstrate the use of constants for processes that have not derived a Profit Centre or documents that have not split the line item by Profit Centre.

You can use Document Splitting rules to split line items on a financial document by Profit Centre. However, there might be accounts (like Bank accounts, Shareholder accounts and Loan accounts) that you do not want to split across multiple Profit Centres. In such cases, it is a good idea to configure Document Splitting rules to define a constant Profit Centre where such line items should post against.

Blogs on Document Splitting

In my series of blogs on document splitting, I intend to explain and elaborate the concepts behind Document Splitting and highlight using examples how document splitting can be achieved for various complex business processes. I use Profit Centre as a “scenario” to explain the functionalities; however all processes that apply to Profit Centre also apply to the other scenarios (Segment, Business Area).

To identify the series of blog, I have categorised the blogs under SAP > Document Splitting. If you have questions/ comments/ suggestions, please send me your comments in the form below. Sharing your questions and experience using comment box below will help other readers to gain additional knowledge involved in this functionality.

Share this blog with your network using one of the social media icons at the top or bottom of this page.

Assumption for this blog

You should read by first 5 blogs to gain an understanding of the concepts around document splitting. These 5 blogs form the backbone of this blog series. Where possible in this blog, I will link the context to the foundation blog so you can refer back to the concept, if you want to.

#1 Overview of new GL Document Splitting Process

#2 Architecture of SAP new GL

#3 The Design driving the new GL Document Splitting process

#4 SAP delivered pre-configuration for document splitting in SAP new GL

#5 The semantics of SAP new GL document splitting process

The configuration for document splitting characteristics for General Ledger for this blog is as below.

Financial Accounting (New) > General Ledger Accounting (New) > Business Transactions > Document Splitting > Define Document Splitting Characteristics for General Ledger

Constant

In Document Splitting design, you can assign standard account assignments (or Constant) for scenarios where it is not possible to derive the correct account assignments for the document splitting characteristics of General Ledger Accounting.

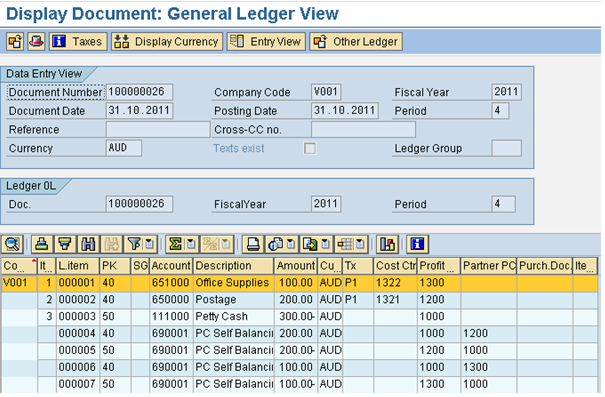

I will use the example of an expense using Petty Cash. I posted this document using SAP pre-configured Document Splitting rules – I have not customised the splitting rules to split the Petty Cash account. As you can see below, the financial document has not split; the Profit Centre against Petty Cash is blank. (The document could generate an error message instead of posting to blank Profit Centre depending on SAP pre-configured rules.)

After a constant Profit Centre 1000 was configured, I re-entered and posted a similar transaction. The Profit Centre now assigned to Petty Cash reflects 1000. There are consequential self-balancing line items in this financial document.

You can compare the financial document in the two scenarios:

- After customising the Document Splitting rules as shown in my previous blog; and

- After configuring a Constant as shown in this blog

Customising Constants for Document Splitting

We will now see how the system is configured to derive a Constant. There are two tables that should be customised:

- Edit Constants for Non-assigned Processes

- Assign Standard Account Assignment to Activation of Document Splitting

Edit Constants for Non-assigned Processes

I created a Constant “BALSH” and assigned Profit Centre 1000 to Controlling Area V000 within this Constant.

Configuration can be done in IMG Path

Financial Accounting (New) > General Ledger Accounting (New) > Business Transactions > Document Splitting > Edit Constants for Non-assigned Processes

Activate Document Splitting

Assign this newly created Constant to the activation of Document Splitting. You can assign only one Constant to Document Splitting activation.

Configuration can be done in IMG Path

Financial Accounting (New) > General Ledger Accounting (New) > Business Transactions > Document Splitting > Activate Document Splitting

After you customise these two tables, you will be able to derive a same Constant on all processes that did not derive a Profit Centre.

SAP standard design for Constant allows you to assign only one Constant per client and configure one “constant” Profit Centre for the Controlling Area. You can override this Constant for specific processes, by another Constant. You have to customise some additional tables to override the client-generic Constant.

Configure restriction on use of Constants

Once you configure a Constant for the client, you can restrict the application of that Constant to individual item category in an individual business transaction. For individual item category, we can

- Assign a Constant for specific item categories; or

- Override the standard account assignment and let the document populate a blank Profit Centre

*** Assign a specific custom Constant for specific Item Category

We can assign a specific Constant for specific Item Categories. In our scenario of expense posting from Petty Cash, for example, we want to assign Profit Centre 1500 (Treasury) and not the default client-generic Profit Centre 1000 to all Petty Cash accounts. To achieve this, we configure the following steps:

* Edit Constants for Non-assigned Processes

We create constant “CSHBA” (Cash and Bank balances) and assign Profit Centre 1500 to Controlling Area V000.

Configuration can be done in IMG Path

Financial Accounting (New) > General Ledger Accounting (New) > Business Transactions > Document Splitting > Edit Constants for Nonassigned Processes

* Define Document Splitting Rule

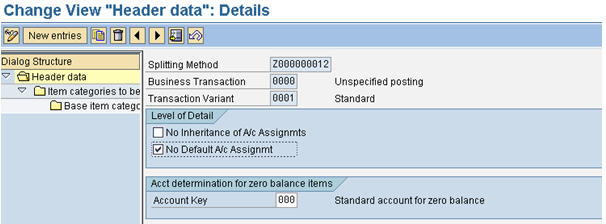

In the Document Splitting rule combination of Document Splitting Method Z000000012 Business Transaction 0000 and Business Transaction Variant 0001 > Base Item Category = 04000, change the Processing Category to 0 (transfer a fixed value (no splitting)). Once this option is selected, the screen changes to allow defining of the Constant. Enter CSHBA as the Constant.

Configuration can be performed in IMG menu path

Financial Accounting (New) > General Ledger Accounting (New) > Business Transactions > Document Splitting > Extended Document Splitting > Define Document Splitting Rule

We will now post an expense through Petty Cash account. As you can see below, the Profit Centre derived against Petty Cash is 1500.

*** Override the standard account assignment

We can decide to override the customised Constant and let specific Business Transaction Variant derive blank Profit Centre. This can be done by selecting the “No Default A/c Assignment” indicator against the combination of Business Transaction and Business Transaction Variant.

Conclusion

There are several ways to customise derivation of a Constant Profit Centre for a business transaction.

It is a good practice to:

- Allow split of business specific GL Accounts like Vendors, Customers, Assets, Inventory

- Define a default Constant for all other Balance Sheet Accounts and

- Define exceptions to this default for specific GL accounts if required by your business

Please Share

I hope this blog has helped you understand the configuration behind document splitting. Please do leave your comments below whether this article was helpful; and whether you have any suggestions/ comments; or if you would like to share your experience with document splitting.

I strongly recommend you share this blog with your network using one of the social media icons at the top or bottom of this page.

You could subscribe to a newsletter from this blog using the rss icon on the top right of this page.

View my presentation on Slideshare

Document splitting in New GL in SAP

Index of my blogs on Document Splitting in new GL in SAP ECC

#1 Overview of new GL Document Splitting Process

#2 Architecture of SAP new GL

#3 The Design driving the new GL Document Splitting process

#4 SAP delivered pre-configuration for document splitting in SAP new GL

#5 The semantics of SAP new GL document splitting process

#6 Set up Zero-balancing for SAP new GL

#7 Customise Document Splitting rules

#8 Use Constants for Nonassigned Processes in SAP new GL

#9 Customise cross company code postings for document splitting

#10 Document Splitting in Cross company code vendor payment

___________________________________________________________

Rajesh has implemented new GL and Document Splitting for several customers. Rajesh has 12 years experience implementing SAP / IT / BPM Finance solutions for several customers globally; he also has 7 years experience working in the business in Finance and Accounting functions. His business process knowledge combined with his IT expertise enables him to provide his customers with best-of-breed advice on business process / IT implementations.

![]()

Great articles. Have you ever tried to change the constant for non-assigned processes after system is live? My client wishes to change the constant (they have assigned a dummy profit center from classic PCA), but so far I haven’t read anything about consequences of doing this. Your insight is appreciated.

Hi Chris

I have changed “constant” profit centre in a live system. I do not remember if we had any problems. The profit centre derivation subsequent to the change will default to the new profit centre. Hence, if (for example) during the year, cash account is defaulted to “Corporate” profit centre and then subsequently changed to “Treasury” Profit Centre, then Cash account will reflect in 2 profit centres for that one year. This works similar to SAPs previous (I think) 3keh/ dummy profit centre scenario.

For my blogs, I have changed / deleted the constant several times to test different scenarios, and this is an IDES system. But I do not see how a productive system will behave differently. the only consequence I noticed was the one I mentioned above.

Rajesh

Hello,

I have activated document splitting. However, I’ve noticed that I am unable to see the detailed split (with the attendant profit center, etc) when viewing the transaction via the ‘general ledger view’. Why is this so?

Please help me out here

Hi Effurun

There could be many reasons –

Have you activated the right document splitting method? Check all your settings again.

Do you see entries in FAGLFLEXA – if you input the company code+document number+fiscal year? if not, then the document splitting has not activated.

Is it deactivated at company code level?

If all above are ok, then you will have to provide me with more information (document splitting method used, type of transaction you are processing, document type of transaction etc) so I can help further.

Regards

Rajesh Shanbhag

Hi

We want to draw profitability in 3 dimensions for our company – which is auto component manufacturer- and 3 dimensions are- Customer , Car line , Plant.

Can I create 3 splitting characteristics for above and achieve this . I mean Customer wise p/l ; plant wise p/l and car line wise p/l as below:

Carline as a Segment

Plant as a Profit centre

Customer as Customer.

Need your expert comments.

Thanks in advance

Cheers

Raj

Hi Raj

Why do you want to use document splitting to draw profitability? What you are trying to achieve is COPA Profitability. Document Splitting will help if you want to split Balance Line item by splitting characteristic – as an example. If you create Customer as a splitting characteristic, you are asking the system to assign a customer to every single Balance Sheet line item. And how do you intend to derive customer on P&L lines other than revenue?

I am not sure if it is technically possible to create “Customer” as a splitting characteristic. Even if it is possible, I would recommend you use COPA. If you want Balance Sheet split by customer, you can create a custom program to load Customer balances into a COPA value field, split by a key figure in COPA. This workaround would be far neater than trying to tweak Document Splitting.

Rajesh

Hi Rajesh,

An independent constant and a constant/default profit center derives a constant/default profit center per controlling area, but how could we make a different profit center constant per company code for nonassigned processes?

Could the BADI FAGL_3KEH_DEFPRCTR be used? Is the BADI activated at the end of the splitting process (after constant derivations) and can it be tweaked to consider only CoCode / PrCtr derivation, independent of accounts?

Thanks,

Gordan

Hi Gordon

You can use this BADI if the profit center has not been determined in other ways. Ideally leave the configuration of constant blank, and then use this BADI to derive the profit center for all scenarios where you wanted to derive a constant (i.e. Balance Sheet accounts and P&L accounts that are not cost elements).

Regards

Hi Rajesh,

It seems that BADI FAGL_3KEH_DEFPRCTR is activated either in the beginning or in the middle of document splitting process. This seems to be the reason why this BADI immediately defines profit center rather than to let the doc.split.rules define the profit center first if it can be derived, and only to react if no profit center derivation is possible otherwise. This way, it derives PC and places it in the entry view (old GL) preventing in certain scenarios adequate document splitting.

There must be another BADI or user exit or BTE whose calling point is at the end of the document splitting process (after the derivation of constant profit center for nonassigned processes)? I found the following BADIs that I think are relevant but am yet to test them. Any ideas?

1. Badi FAGL_DERIVE_SEGMENT

2. Badi GLT0_COMPLETE_ASGMT

3. Badi GLT0_REPLACE_ASGMT

Also, found the following BTEs which may be relevant. Any ideas here as well?

00001011 POST DOCUMENT: Checks at line item level

00001020 POST DOCUMENT: Prior to final checks

00001025 POST DOCUMENT: Final checks completed

00001030 POST DOCUMENT: Posting of standard data

00001085 POST DOCUMENT: Functions for Line Item

00001110 CHANGE DOCUMENT: Save the standard data

00001120 CHANGE DOCUMENT: GUI Callup at line item level

00001130 CHANGE DOCUMENT: Key texts

00001150: Offset account determination

Thanks,

Gordan

Hi Gordon

Apologise, I have not been able to get any feedback on this BADI from my network either. I do not seem to know anyone who has used this. I have not had a reason to use this either. So I cannot provide any advise on this. Hope you have found some response from SAP on this.

Rajesh